We are currently updating our site; thank you for your patience.

Company

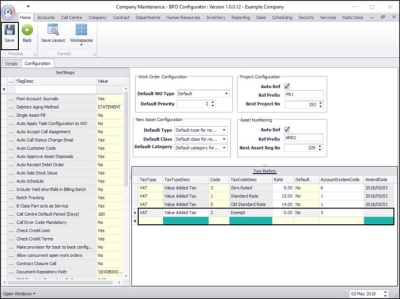

Company - Setting Up Tax Rates

Tax rates need to be set up so that you can add tax to items e.g. 15% VAT on stock sold.

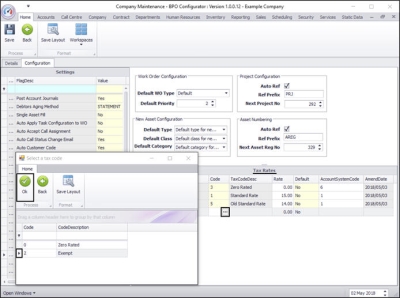

| Ribbon Access: Configurator > Company > Company |

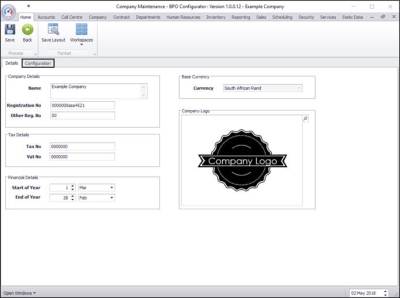

- The Company Maintenance screen will be displayed.

- Click on the Configuration tab.

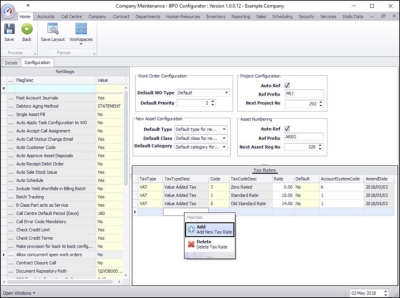

- You can now view the Tax Rates frame.

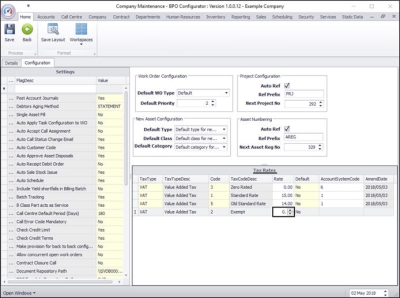

- Right click anywhere in a row of the Tax Rates data grid.

- A Maintain menu will pop up.

- Click on Add - Add New Tax Rate.

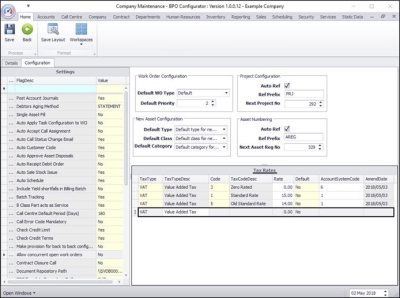

- The final row in the data grid will be 'activated'.

- The Tax Type, Tax Type Description, Rate and Default columns will now be populated.

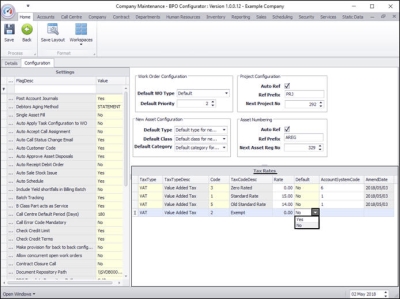

- Click in the Code text box to reveal an ellipsis button.

- Click on this button to display the Select a tax code pop up screen.

- Click on the row selector in front of the tax code that you wish to link to this company.

- Click on Ok.

- The Code and Tax Code Desc columns will now populate with the selected code details.

- Click in the Rate text box and either type in or use the directional arrows to select the tax rate (percentage value).

- Click in the Default text box to reveal a drop-down menu.

- Click on Yes if the Tax Rate is to be used by default.

- Click on No if the Tax Rate is not to be used by default.

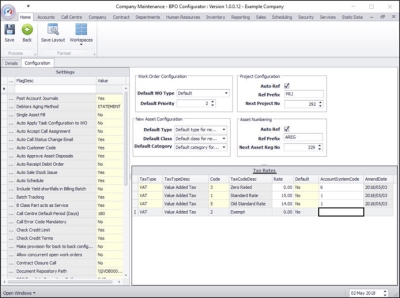

- Click in the Account System Code text box and type in an account system code for this new tax rate.

- When you have finished adding the new tax rate details, press Enter.

- Note: The Amend Date column will be adjusted by the system.

- The new tax rate code will be saved and a new row will be added the Tax Rates data grid.

- Click on Save .

MNU.091.010