We are currently updating our site; thank you for your patience.

Procurement

Supplier Debit Note

Debit notes are used in transactions when a debit entry adjustment is required in a case where money is owed. Debit notes reflect adjustments or returns on transactions that have already taken place.

For example, a Debit Note can be raised if your company has purchased goods from a supplier and would like to return the goods for a valid reason or the supplier has sent an invoice to your company for a lower amount than the actual cost.

The Debit Note will include the total anticipated credit and an inventory of the returned items.

A Stock Supplier Return / Non Stock Supplier Return must be raised before the supplier Debit Note can be added.

A Supplier Debit Note reverses a Supplier Invoice.

Only once the Supplier Debit Note is Accepted, will the relevant accounting transactions post.

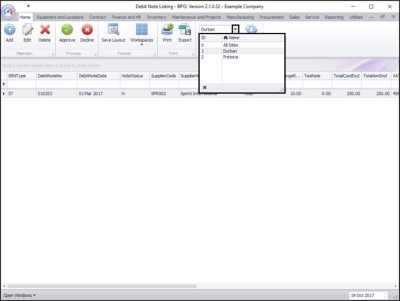

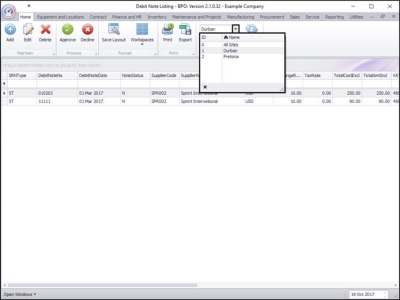

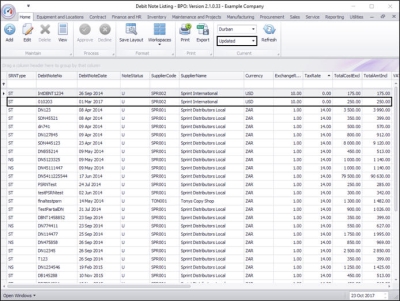

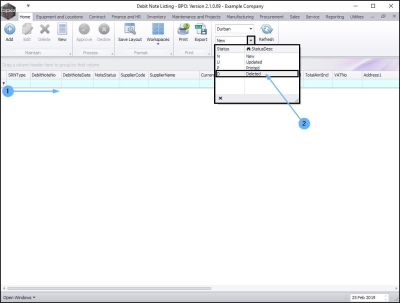

| Ribbon Access: Procurement > Debit Notes |

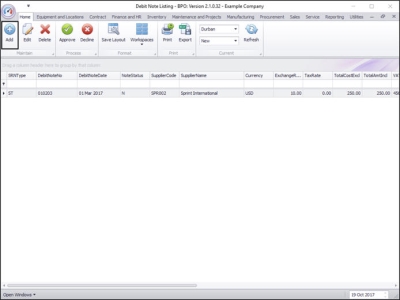

The Debit Note Listing screen will be displayed.

- Select the Site.

- In this image Durban has been selected.

Create Supplier Debit Note

- Click on Add.

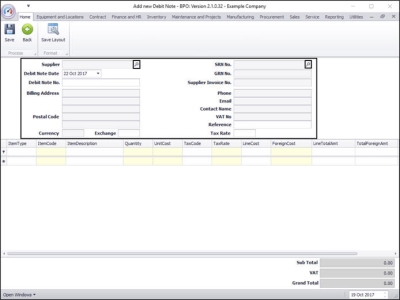

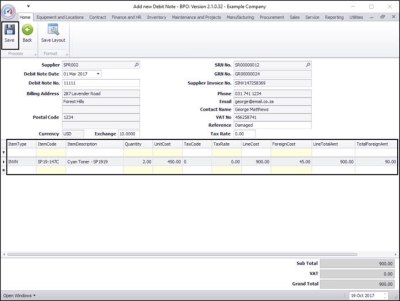

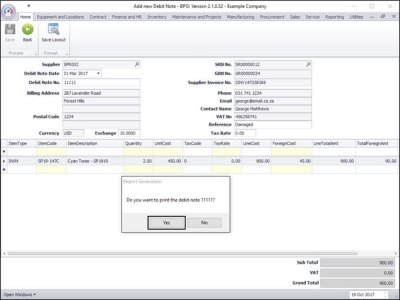

The Add new Debit Note screen will be displayed.

Supplier Details

- Supplier: Search for and select the Supplier.

- SRN No: Search for and select the Supplier Return Note Number.

- GRN No: This will auto populate as the SRN No. is selected.

- Debit Note Date: Will auto populate with the current date. You can either type in or click on the drop-down arrow and use the calendar function to select an alternative date, if required.

- Debit Note No: Type in the Debit Note Number.

- Billing Address, Postal Code, Currency, Exchange, Phone, Email, Contact Name, VAT No, Tax Rate will all auto populate as the Supplier is selected.

- Reference: Type in a reference, if required.

Debit Note Items

- Items: The Debit Note items will pull through from the Supplier Invoice details.

Save Debit Note

- When you have finished adding the details to this screen, click on Save.

Print Debit Note

- A Report Generation message box will pop up asking;

- Do you want to print the debit note [ ]?

- Click on Yes.

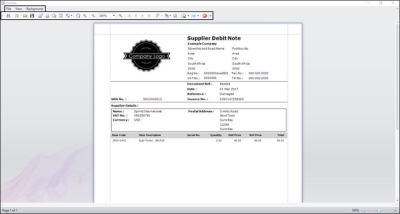

Report Preview

The Report Preview screen will be displayed.

- From here you can View, Print, Export or Email.

- Close the Report Preview screen when done.

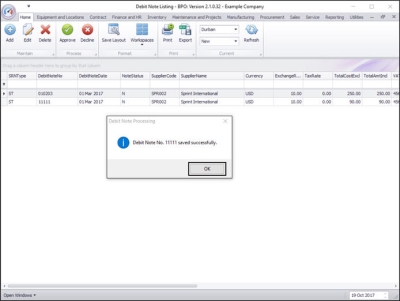

You will return to the Debit Note Listing screen.

- A Debit Note Processing message box will pop up informing you that;

- Debit Note No. [ ] saved successfully.

- Click on OK.

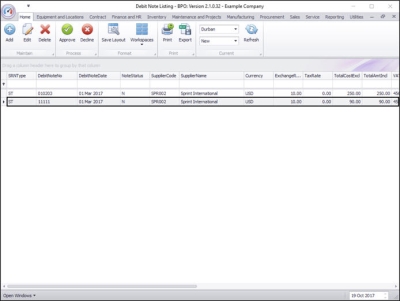

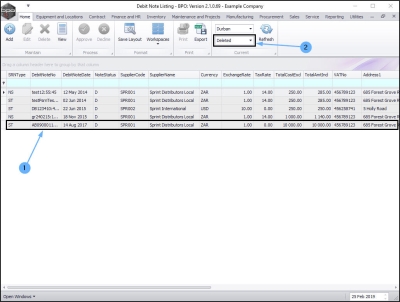

View Debit Note

- The newly created Debit Note can now be viewed in the Debit Note Listing screen.

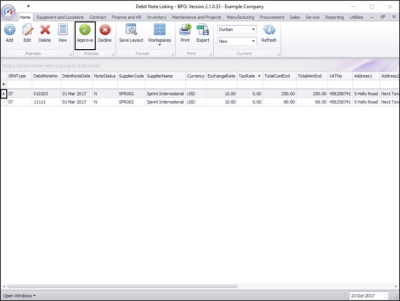

Approve Supplier Debit Note

- In the Debit Note Listing screen,

- Select the Site.

- Click on the row selector in front of the Supplier Debit Note to be approved.

- Click on Approve.

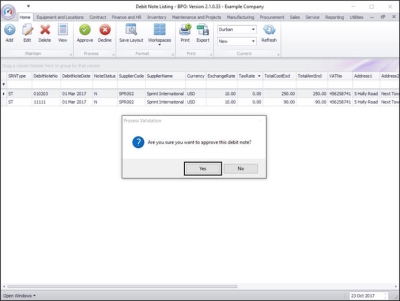

- A Process Validation message box will pop up asking;

- Are you sure you want to approve this debit note?

- Click on Yes.

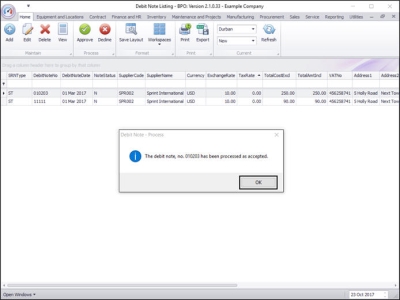

- A Debit Note - Process message box will pop up informing you that;

- The supplier debit note, no [ ] has been processed as accepted.

- Click on OK.

- You can now view the Approved debit note in the Debit Note Listing screen where the status has been set to Updated.

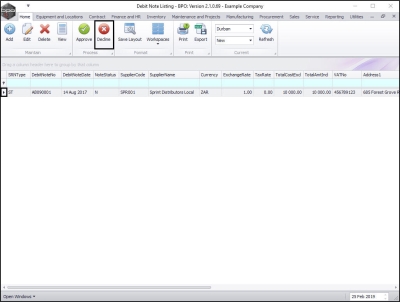

Reject/Decline Supplier Debit Note

- In the Debit Note Listing screen,

- Select the Site.

Select Debit Note to Decline

- Click on the row selector in front of the Supplier Debit Note to be rejected/declined.

- Click on Decline.

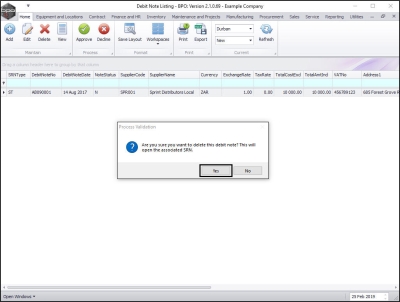

- A Process Validation message box will pop up asking;

- Are you sure you want to delete this debit note? This will open the associated SRN.

- Click on Yes.

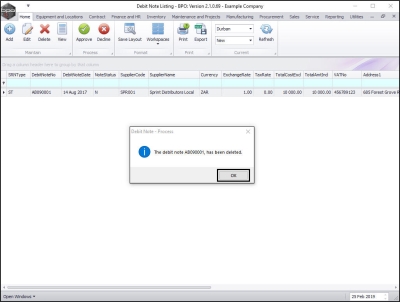

- A Debit - Process message box will pop up informing you that;

- The debit note [ ], has been deleted.

- Click on OK.

- The Debit Note will be removed from the Debit Note Listing screen where the status is set to New.

- Change the screen status to Deleted .

- The Debit Note can now be found in the Debit Note Listing screen,

- where the status is set to Deleted.

BPO.MNU.036