We are currently updating our site; thank you for your patience.

Equipment

Assets Depreciation History

Assets lose their value and depreciate over time. Depreciation means that you can write off the value of the asset over its expected useful life.

For accounting purposes, depreciation represents how much of an asset's value has been used up over time and can be deducted as an expense against your company taxes.

Criteria for calculating depreciation:

- The initial cost of the asset.

- The expected residual value (or 'salvage' value) - this is the value of asset at the end of its useful life, (which may be zero).

- The estimated years of useful life of the asset.

- An appropriate method of apportioning the cost of the useful life of the asset.

A simple straight line depreciation method is used in BPO for computing and reporting depreciation. In essence this calculates the same amount of depreciation expense each year.

To calculate the depreciation charge:

- Step 1: Deduct (ii) from (i) - the result is the asset's 'depreciable cost'.

- Step 2: Divide the value of Step 1 by (iii)

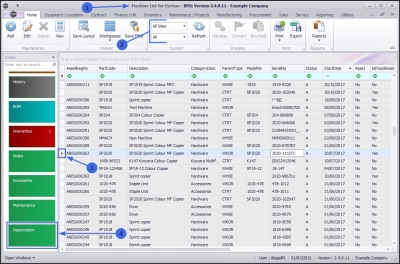

| Ribbon Access: Equipment/Locations > Assets |

- The Machine List for [] screen will display

The Site and Type Filters

- The screen will open with the default Site setting configured on the user and the Equipment Type filter set to 'All' (machines).

- Note: You do not need to select a specific Site or Type, however, if you wish to narrow your asset filter parameters, you can click on the drop-down arrows and select a particular Site and Type from the list.

Note: Refer to Site Selection for more information about Site settings.

Select Asset

- Select the row of the asset where you wish to view the depreciation information. The selected row will highlight.

- In the Links panel, click on the Depreciation tile.

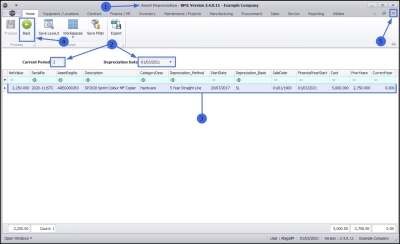

- The Asset Depreciation screen will display.

Period and Depreciation Date

- The screen will open with the current financial Period and Date displayed.

Asset Depreciation Details

- You can view only the following details in this screen:

- Net Value: the current value of the asset.

- Serial No.: the unique asset number given by the manufacturer, used for identification and inventory purposes.

- Asset Register No.: the unique asset number given by the company.

- Description: a brief description of the asset.

- Category Description: the category the asset falls under e.g. hardware.

- Depreciation Method: the method used to calculate the depreciation of the asset.

- Start Date: the date at which the asset was first available for use and depreciation began.

- Depreciation Basis: the amount of the asset's cost that can be depreciated over time.

- Sale Date: the date this asset was acquired. Depreciation expense must be computed up to this sale date.

- Financial Year Start: the date that the company's financial year starts.

- Cost: the initial cost of the asset.

- Prior Years: the total accumulated depreciation amount for the asset through the preceding years.

- Current Year: the depreciation amount for the current year.

-

Note: You cannot edit the Depreciation details from here, note that there is only a Back button and no Save button.

-

Close the screen or click on the Back button, to return to the Machine List for [] screen.

MNU.008.003